Open Banking is now expanding towards the broader revolution of Open Finance, which goes beyond any regulatory framework and is designed to share more precise data across a broader range of services.

The Open Banking practice is being embraced across the globe and is disrupting the Banking industry. It provides third-party financial service providers open access to consumer banking, transaction, and other financial data from banks and non-bank financial institutions, through the use of application programming interfaces (APIs). Customers are, in this way, empowered to do more with their financial data, while new opportunities arise for businesses in multiple industries to offer new financial services. Any organization can now embed powerful banking capabilities into its own processes to deliver brand new capabilities, streamline customer onboarding, build better risk profiles and reduce transaction costs.

![Featured Resource: Embracing a Transformative Approach to Business-led Integration [Read Now]](https://no-cache.hubspot.com/cta/default/8019034/9919b744-7cf0-4636-8c23-71fd85f681a4.png)

Global Open Banking trends:

- The global Open Banking market is projected to reach $37.77 billion in 2025 at aCAGR of 25.7% (source: Research and Marketers)

- The number of Open Banking users worldwide is expected to grow at an average annual rate of nearly 50% between now and 2024 (source: Allied Market Research)

- 132.2 million individuals worldwide will use open banking services by 2024 (source: Allied Market Research)

Macro use cases:

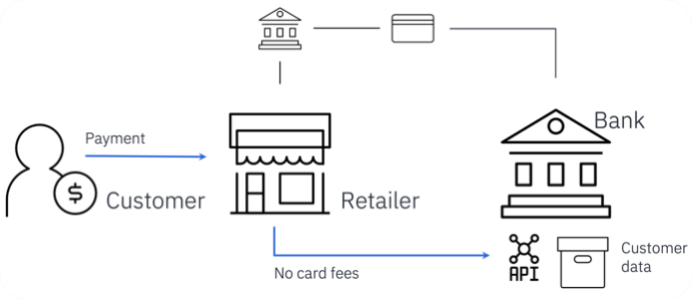

Simplify payments & reduce costs: An online retailer, for example, can initiate a payment directly by invoking the APIs of the bank holding the customer’s account. It doesn’t need to go through a card scheme anymore and can significantly reduce transaction costs.

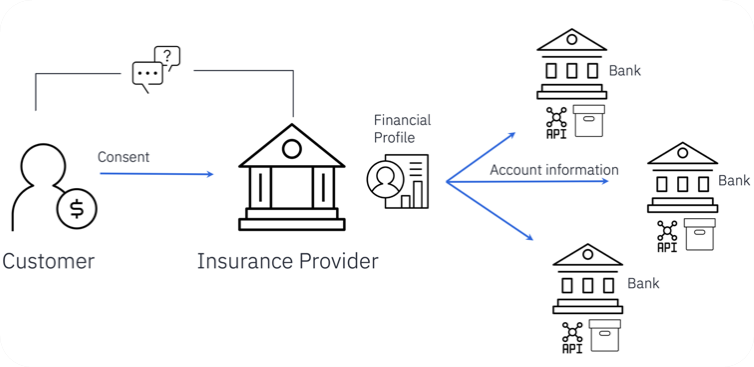

Aggregate customer information: Traditionally, organizations such as insurance providers have to collect a lot of information directly from the end users. As a result, new insurance applications suffer from a high customer drop-off rate.

With Open Banking, the same organizations can just ask for user consent, automatically retrieve account information from all the institutions the customer is banking with, and quickly build a very precise risk profile.

See also: 4 Challenges for Open Banking Integration

Open Banking leads to Open Finance

Open Banking started with regulatory changes aimed at increasing open access to financial data. This initiative, which has been a big shift for the Banking Industry, is now expanding towards the broader revolution of Open Finance, which is considered to be the next step of the Open Banking journey.

Open Finance goes beyond any regulatory framework, and it is designed to share more precise data across a broader range of services, enabling access to a customer’s broader financial footprint and increasing the speed at which business can get conducted.

This new trend is set to drive even more innovation and competition between services, providing embedded, personalized solutions and supporting financial inclusion.

The key role of integration

The Open Banking and Open Finance revolutions rely on the creation of Open Ecosystems. This opens new opportunities to:

- expand access and use of external data sources that reside outside of the enterprise boundaries;

- build solutions that leverage much broader data sets.

To realize value from data is not always easy. First of all, you need to connect to a large number of endpoints. Each endpoint may be different and may change or update independently at its own speed. You need to reliably move a large amount of information through an unreliable network and deal with all the security aspects of those interactions. You must also move fast and be agile: you have the opportunity of accessing all these resources, but you are also on a level playing field with all your competitors. The better integrated you can make this new set of data with your existing infrastructure, the more you can take advantage of it. Integration is the key to maximizing value from this opportunity.

IBM Cloud Pak for Integration is a comprehensive set of capabilities that empowers you to effectively address these use cases:

- Connect applications and systems faster than ever before. Exploit hundreds of pre-built smart connectors and a no-code interface with AI-powered mapping suggestions.

- Create integration flows that are triggered by real-time events, delivering a more responsive user experience to your clients and developing a competitive advantage.

- Leverage End-to-end security to control access to vital resources, wherever they are.

- Ensure that changes to critical financial data happen once and once only.

Unlock the full potential of Open Banking and Open Finance with IBM

With the IBM Cloud Pak for Integration, you can embrace the Open Banking and Open Finance initiatives, bringing innovation in every aspect of the banking customer journey and driving competitive advantage. The number of innovative services that can be delivered thanks to these technologies is expansive, from simple use cases to the most complicated customer needs. Some examples include:

- Finance monitoring: a mother can easily check through her Open Banking app the financial situation of her daughter, proactively sending her money when required;

- Affordability checks using accurate data: when landlords want to evaluate a tenant’s ability to pay rent, Open Banking account information offerings can perform affordability checks securely and compliantly, without requiring tenants to provide any bank statement or bill.

- Rent recognition: powered by Open Banking, it ensures that rent payments are automatically reported and recorded in your credit score to improve credit history;

- Cheaper rates when paying abroad: open banking providers are developing offerings that offer competitive FX rates at the point of sale.

- Income streaming: with Open Banking, users can stream a percentage of wages as they are earned, validated against upcoming wages. This is a great alternative to traditional, expensive overdrafts for a one-off fee.

To demonstrate the implementation of these types of use cases, let’s start with a basic implementation example, the Finance Monitoring that has been introduced above.

Basic implementation example: a peer to peer payment app for Finance Monitoring

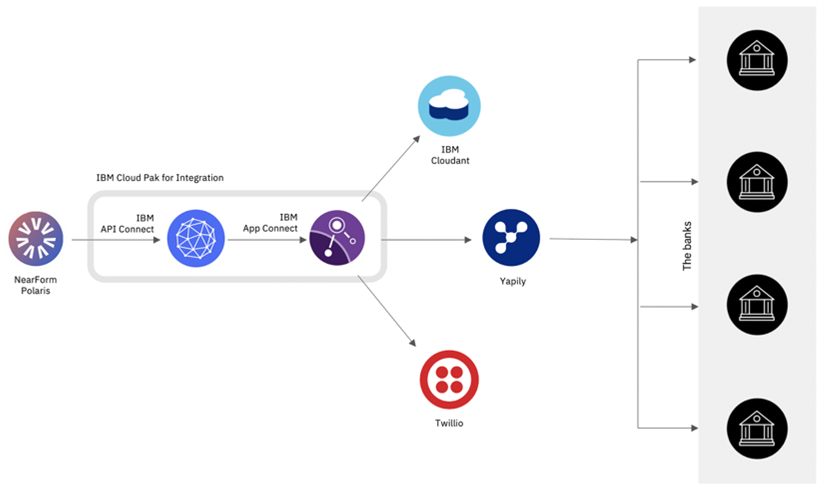

IBM collaborated with Nearform and Yapily to build an Open Banking reference app, which is an example of an end-to-end third party solution built on top of the public APIs exposed by banks.

Our main scenario involves two personas: Anne-Marie and her daughter Sophie. The app enables Anne-Marie to keep an eye on Sophie’s financial situation and help her when required. Behind the scenes, the solution uses open banking APIs to access Sophie’s account information and initiate payments from Anne-Marie’s accounts. The brief video below walks you through the end-user experience.

Technical solution

This scheme represents the end architecture behind the reference app. The front end has been developed by NearForm as a React Native app, now available as an open-source asset. The app consumes APIs that are exposed by IBM API Connect, a solution part of the IBM Cloud Pak for Integration.

IBM API Connect enforces access policies and gives you all the capabilities required to manage the lifecycle of a public endpoint. The logic behind those interfaces is configured in IBM App Connect, also part of the IBM Cloud Pak for Integration. This aggregates the functionality of the APIs exposed by banks and controls the flow of data between the banks and Cloudant, the operational data store. Every bank has a slightly different set of endpoints. For this reason, we have integrated App Connect with Yapily, which acts as a single gateway to any bank.

This simple solution demonstrates how in just a few days, a bank could use these tools to deliver new value to their customers. Expand your open banking and open finance initiatives today by getting started with our free trial.