IBM Cloud Pak for Integration can help insurers quickly and effectively integrate weather data into their business processes to mitigate risk and deliver enhanced customer experiences.

Climate change is leading to extreme weather events, which represent a significant risk for the insurance industry. The most recent trends clearly outline the extent of this risk:

- Insured catastrophe losses have increased over the past five years to $96bn per annum from $44bn per annum in the prior five-year cycle (source: NOVA).

- In 2021, insured catastrophe losses continued the trend of an annual 5–6% rise in losses seen in recent decades (source: Swiss Re).

The increase in extreme weather events is not only causing progressively higher losses for insurers but also a steep increase in claims that insurance companies have to process.

To better manage these weather-related risks, insurers have to quickly adapt their services and internal processes.

Data is the best ally for insurance companies when it comes to reducing insured catastrophe losses; in particular:

- historical weather data can help them determine where new events are more statistically likely to happen;

- advanced weather forecast technology can be used to promptly alert customers at risk of extreme events to lower their exposure and potential damages.

At the same time, insurers have to automate their support services and insurance claim submission processes in order to reduce the impact of increasing claims instances. This will avoid potential frauds, reduce process lead time and improve the customer experience.

The role of integration

To succeed in these use cases, insurers have to connect their applications and systems to databases that reside outside of their company’s boundaries, automatically retrieve weather information for each specific location, retrieve from their CRM software the list of customers at risk for extreme weather events, connect to their internal database where specific information about customer’s assets are collected, and so on. All these tasks involve different applications, systems, and endpoints, which may be located outside of the company’s boundaries, and may change or update independently at their own speed. Insurers also need to reliably move a considerable amount of information through an external network and deal with all the security aspects of those interactions. Therefore, to efficiently perform these tasks, all the underlying applications, systems, and endpoints need to be successfully integrated.

Let’s see how IBM Integration seamlessly works to help insurers mitigate risk and their customers to have valued experiences.

Effectively manage peaks in insurance claims and identify frauds – the storm example

The chaos after an extreme weather event such as a serious storm can be devastating. Many people who are badly affected are likely to contact their insurance company to find basic information about how to make an insurance claim and claim compensation for the damage caused by the storm. With this sudden load, the supporting systems are often overwhelmed, and communication lines get congested with claim requests and questions.

What do I do if my home’s been flooded or damaged in a storm? How to make an insurance claim? What do I need to submit for an insurance claim? Who will assess the damage? When should I make an insurance claim?…

In times of crisis, fraudulent requests also surge, which in turn forces insurance companies to apply tedious processes for a claim evaluation. Multiple layers and checks to discriminate between fraud and genuine claims are time-consuming for both parties, which usually creates frustration among genuine victims and loyal customers.

Insurers can avoid the chaos with IBM’s integrated technology.

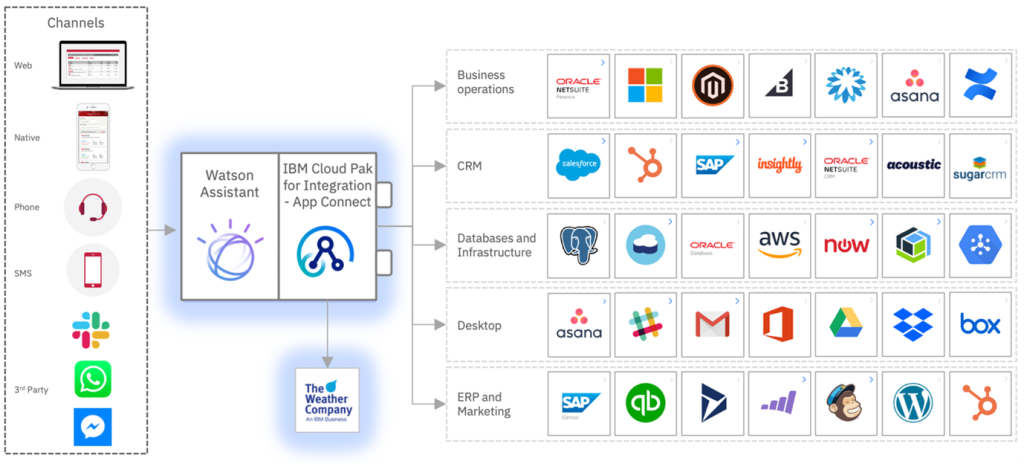

IBM Cloud Pak for Integration empowers insurers to easily connect their systems to business applications that help them address extreme weather-related issues, such as weather services. Connecting support systems to weather services and chatbots can play a critical role in helping insurance companies to quickly gather information about storm damage, accelerate the process of claim evaluation checks and offer a smoother user experience.

In particular, IBM App Connect, the Application Integration Capability within the IBM Cloud Pak for Integration, includes a pre-built smart connector to the Weather Company Data, together with a no-code interface and AI-powered mapping suggestions to easily configure this integration. With App Connect, you can rapidly pull the capabilities of this integration directly into your chatbot assistant, such as Watson Assistant, with little to no coding required (see how).

Connecting your integration to the IBM Watson Assistant will allow you to build, train, and deploy conversational interactions that take place as a first step in claiming storm damage and assisting the victim about the process. It will also validate the data to filter fraudulent claims by leveraging detailed historical weather data from The Weather Company, reducing the frustration for the victim.

IBM Cloud Pak for Integration also elevates your chatbot experience from intelligent conversational interactions to real, cognitive system interactions by integrating with multiple applications.

See IBM’s products in use à link (the integrated solution architecture)

Proactively notify customers about the risk of extreme weather to minimize damages

Another way to mitigate the impact of extreme weather events on insurance companies is to adopt preventive measures that help reduce damage for the end customers.

Modern weather forecasting services, such as The Weather Company, have higher accuracy that insurers can use to proactively notify their customers about specific weather conditions that could impact the area where they operate. Based on the type of business and physical assets that each customer has and the type of weather warning that is being notified, insurers can include a set of preventive measures to be adopted in order to minimize the damage.

To implement such advanced solutions, insurers need to seamlessly connect their Customer Relationship Management (CRM) systems with weather forecasting services data and email services (or other notification services).

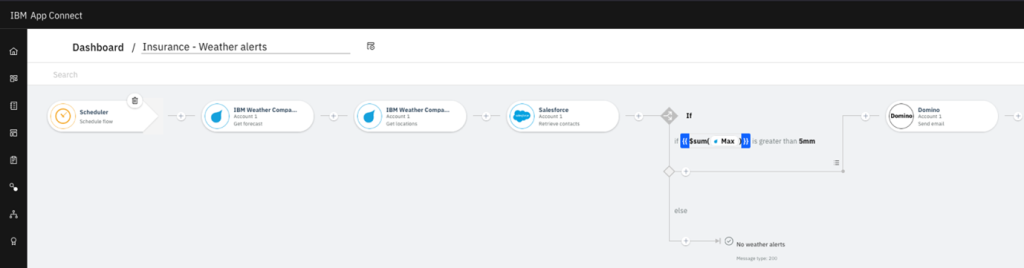

The IBM Cloud Pak for Integration lets you instantly connect these applications with its pre-built connectors to CRMs (e.g., Salesforce), weather forecasting services (e.g., The Weather Company), and email services (e.g., Domino). It also features a no-code interface and AI-powered mapping suggestions to easily configure each integration, speeding up time to value for citizen integrators as well as developers.

For example, a scheduler will start the integration flow every hour, letting the integration flow retrieve from The Weather Company the forecast and location information, will then retrieve from Salesforce the information for each specific customer in the affected area that could be affected, and whenever the alert conditions will be met (e.g., higher level of precipitations or wind than the limit) will send via Domino a personalized weather alert with countermeasures to mitigate the risk of damage for the end customer.

These two use cases highlight how insurers can quickly and effectively integrate weather data into their business processes to mitigate risk and deliver enhanced customer experiences. To experience the Cloud Pak for Integration yourself, get started today with our free trial.