Modernizing accounts payable is the need of the hour in many businesses. That often means supporting cutting-edge features and self-sufficient automated workflows.

The Accounts Payable (AP) ecosystem carries a considerable amount of vulnerabilities to errors, financial outflow, and litigations in almost all organizations. Realizing these core burdens, the senior finance leaders will invest in initiatives to automate and streamline AP. In the immediate days, these digital solutions transform the AP processes, but in the long run, they fail to generate a high value.

The lack of value monitoring, course corrections, future-forward changes, and other oversights lead to value leakage in the post-implementation phase. The digital solution that was once driving and supporting the AP procedures is now unable to unlock any more value. In some cases, the legacy system even fails to match the expected value with the derived value.

You can easily avoid these hassles by following a value-oriented approach. Let’s see how a value-based framework can help to capture and exceed your established value from accounts payable.

See also: Perfect Partners: Payment Orchestration and Open Banking

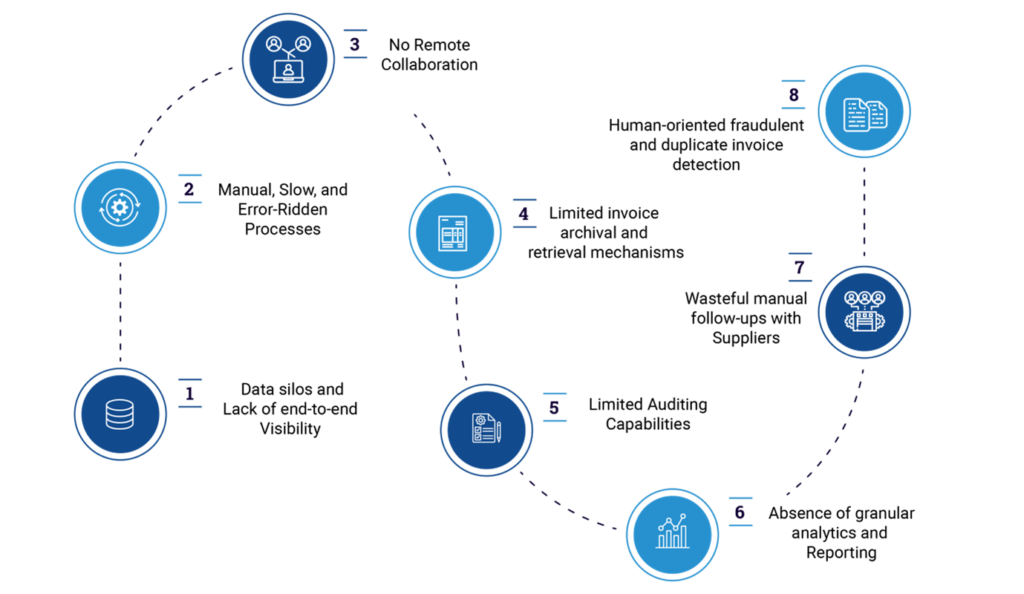

Challenges in accounts payable

The accounts payable department doesn’t often extract the best value from its investment. Despite a strong-strategic push towards automation in recent years, many AP ecosystems are still struggling with a barrage of problems. Most organizations are yet to fully overcome late payments, resulting in penalties, lost discounts, and other bottlenecks. The challenges remain mostly unsolved!

The investments in AP often fail to generate a high Return on Investment (ROI), mostly due to mismatched priorities, dated technology, out-of-sync workflow, minimal funds, and other factors that create the following challenges in AP:

- Highly manual, slow, and error-ridden data entry and other processes. Exception handling and approvals increase invoice processing time.

- Little to no visibility for approvers, higher AP heads, and senior leadership

- Inability to accomplish tasks remotely. Presence in the office mandatory to clear invoices

- Inability to store and retrieve invoices in a time-efficient manner. Still relying on manual storage. This leaves you vulnerable at the time of an audit and could potentially result in fines.

- An ineffective system to establish who and when made any changes on an invoice.

- A legacy human-oriented process in place to detect fraudulent and duplicate invoices – most such invoices bypass the low-level barriers with ease.

- A manual process to segregate and fulfill invoices based on early payment discounts, which is unable to optimize the process. In most instances, payments go on a first come, first serve basis.

- Absence of analytics and reporting to identify gaps, under-performing areas, and error-ridden roles and initiate process improvements. No insight into the pivotal KPIs in AP to measure and make concrete changes.

- Still chasing down suppliers for updates and other communication

Most of the AP processes are still stuck with dated technologies and slow workflows that don’t yield the best outcomes. Improving AP efficiency and cash flow is a daunting task, but such complex processes require innovative solutions; it requires more than just automation!

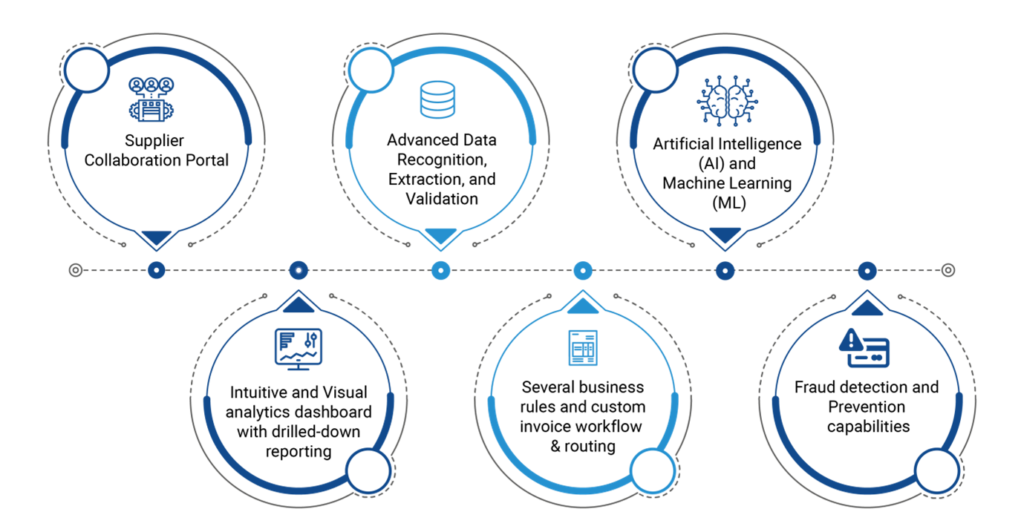

Solutions to elevate your accounts payable

So, the question arises of what can AP teams do to elevate their processes to make the ecosystem more robust and coordinated. They would probably need a system where tasks, queries, and other requests flow smoothly – not just internally but with the suppliers as well. A unified and centralized system integrated with cutting-edge features will help to ensure maximum value from your AP.

AP teams can realize more value by incorporating essential capabilities into their ecosystem. Doing so will help improve their operational efficiency, reduce delays, create time efficiency, and go on to influence their financial lever, which then helps free up year-end cash, improve cash flow, increase working capital, and increase the bottom line.

These capabilities include, but are not limited to:

- Supplier collaboration portal to chat, communicate and view the status of invoices and other documents on a user-friendly and intuitive platform

- Advanced data recognition and extraction to detect invoice layout and auto-populate fields within the system with the least manual intervention and data entry errors.

- Artificial intelligence (AI) and machine learning (ML) to recognize invoices and learn from past invoices to improve the performance of future invoices.

- Invoice archiving to help with easy and time-efficient retrieval at the time of audit. Plus, reduce expenses in storing invoices in paper trays and cabinets.

- Powerful analytics with drilled-down reporting to measure, monitor, and improve the way you handle your AP. This helps to identify underperforming areas.

- Custom business rules to build your invoice workflow, for maximum productivity and a fast invoice processing cycle, for however many approvers.

- Fraud detection and prevention features to avoid overpayment and burdening your working capital.

Such high-end functionalities in your AP system help manage your AP workload more effortlessly. The functionalities make it easier for AP clerks to process their side of things, creating more visibility for everyone in the hierarchy, including remote workers, and helping you make concrete changes to optimize, transform, and scale your AP.

Value-oriented design of AP solution

Adopting a value-oriented approach is the best way to realize maximum value from your AP processes. Such an approach identifies process improvement opportunities, redesigns the processes, suggests critical capabilities, and detects incremental value-addition possibilities to influence your operational and financial efficiency.

Businesses can initiate a process to incorporate more value additions to their accounts payable model. These value additions will improve operational efficiency and go on to impact the financial levers. Embrace a value-oriented framework to redesign the existing processes and accelerate the same to unlock more value from your AP.

The value-based approach helps to uncover gaps, silos, bottlenecks, and other issues within your AP. Once identified, you can start addressing them with AP best practices and the right set of powerful capabilities that will empower your team with a means to make your invoice management more holistic and seamless.

Incremental value additions to your AP

Any value addition to accounts payable comes from a place where you wish to reimagine your procedures and be more strategic about how you handle your cash burn and regulate your spending habits. Strengthening financial controls has caused many companies to deviate from their usual procedures and explore other models that can simplify their AP and make it more cost-effective.

A value-oriented framework for your AP ecosystem will result in several benefits. Your organization, as a result of adopting the framework, will realize these three significant values:

- Reduce cost of goods sold (COGS)

- Improve productivity

- Improve audit and compliance procedures

Operational values: By integrating a set of powerful capabilities in the invoice processing cycle, your AP team witnesses a significant improvement in how invoices are handled and posted. Your AP successfully eliminates the core error-ridden and manual data entry actions, reduces the invoice cycle time, improves transparency, better’s productivity, and on the whole, streamlines the invoice processing significantly.

Automated AI-driven processes with machine learning help to smoothen AP procedures. What would have otherwise been a manual and cumbersome approach starts to dissolve and become more simplified. The process improvements help the members in more value-based and business-critical activities rather than occupying them with rectifying errors and other painstaking wasteful tasks.

Financial values: You reduce the likelihood of non-compliance irregularities, which means fewer litigation expenses and resulting penalties. Additionally, you start capturing more early payment discounts and save a ton of money from paper costs and storage charges. Overall, a user-friendly collaboration interface allows you to improve your supplier relationships for better discounts.

Your AP team improves its working capital and becomes a significant contributor to the company’s cash flow strategy. When the expenses that eat into your revenue come down, your bottom line looks much better. Slowly, your AP unit can reduce the cost of goods sold, which could mean better profit margins when selling to distributors and wholesalers.

Wrapping up

Modernizing your accounts payable is the need of the hour. This means supporting your AP with advanced functionalities that help to make it easier, more efficient, and safer. A growing and scaling AP needs a robust set of cutting-edge features and a self-sufficient automated workflow to run the daily routine and handle the high volume of invoices more seamlessly.

The idea of operating with legacy procedures, in a dated setup, with a high workload, minimal data-driven insights, and high vulnerabilities, invites liabilities and slows down your ability to close payments. You would need to innovate and bridge the gap between accounts payable and vendors; this comes through taking an intelligent value-based approach – customized to your unique business needs.

A robust and systematic value-oriented approach concentrates on enhancing how you serve your suppliers by serving your AP better. If your internal processes are more coordinated, in order, and transparent, everything falls into place, and you automatically build a better rapport with your suppliers. To serve suppliers better, serve yourself even better.