Sanjeev Sularia, CEO of retail analytics leader Intelligence Node, looks at why real-time pricing optimization is now the only sales strategy that makes sense.

The days of the dramatic markdown for the online shopper between “this price right now” and the “real” price are over.

There used to be a time when all e-commerce retailers attracted buyers with “list prices” or “official prices” and would claim to slash discounts to get a sale.

The end result was that it became impossible for the customer to bear any kind of non-discounted price for anything on the internet. We all know this in retail, but our real-time database has been telling us this with hard numbers. We monitor 130,000 brands across 1,100 categories; and in North American sales, only a minority of items ever sold at list price — and never north of 45 percent. In some categories, like precious stones and gems, camera accessories, bakery products, baking ware — all the way to food cupboard staples like sauces, marinades & dressings, ready-for-consumption frozen and pet-care merchandise — only one in 10 purchases ever sold at list price.

In any case, this manic online discounting culture has caught the attention of the authorities. Mentioning any centrally fixed price you are undercutting is becoming “a sales tactic that is drawing legal scrutiny, as well as prompting questions about the integrity of e-commerce,” according to a New York Times article earlier this year.

The fabled standard price will disappear

Amazon is now taking steps to stop listing manufacturers’ suggested retail prices. And where Amazon goes – we’re all going to follow. Plus with the FTC (Federal Trade Commission) investigating these strategies, the standard price will disappear online and for good.

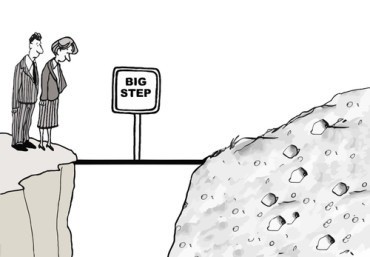

That’s going to raise some big questions for retailers. That’s because getting online dynamic pricing right is one of the most difficult issues in online retail, because it is a major challenge to keep up with such a fast-moving marketplace. If the price is too high, the online shopper simply jumps to another site. If too low, the online shop risks its profit margin, and as a pernicious side effect, builds a customer base that expects huge discounts every time they shop.

As we know, online shoppers like nothing more than comparing prices. Keeping prices on par with the competition is therefore extremely important to any online retailer’s ongoing strategy. Real-time, dynamic pricing based on changes in demand is the only solution that can satisfy online shoppers’ continuous quest for a bargain. At the same time, pricing response time is critical.

The only way to keep up is via technology-enabled flexible / automated optimization. Automation is in fact the only way online retailers can optimize pricing, 24/7, as the global market changes rapidly – and to succeed online retailers need to be able to change pricing to keep up with and edge out the competition.

Real-time optimization tools will be key

The contribution of any pricing technology, plainly, has to be its ability to drive revenue, margins and profits with better insights into pricing levels and shopper behavior in real-time at a granular level. Dynamic pricing should have the ability to adjust to changes in the market and consumer trends quickly, as well as focus on only products and competitors the retailer believes are relevant at the time.

An example of real-time optimization coming to the fore is basket pricing. Take Jet.com, recently acquired by Walmart, which makes extensive use of smart algorithms to prompt and support a great site visit. The company’s model is built around deeper discounting when more is added to a basket, which keeps shipping costs down.

Jet’s software program has been described as “like a real-time trading platform.” It digs out ways of making purchasing more efficient, so if you order cat food and a cat bowl, the software will find out if you can buy a cat bed at almost no additional shipping cost, enticing the customer into making another purchase.

Clearly, Walmart decision to purchase Jet.com, which puzzled many as the company actual sales were so modest, was driven by exactly this online shopping experience.

Like Walmart, you need to have the tools to know how the markets are working and price accordingly. It’s the combination of clear volume, pricing and revenue goals, with automated real-time price adjustments constantly working in the background, plus smart tactics like basket pricing, that will help retailers stay ahead of the game in the ‘no list price’ zone that is ecommerce today.