The tech industry has struggled to attract and retain women in the workforce. Addressing the issue could have an impact on the bottom line as a 10% increase in women on an ESG board strongly correlates with a 1% increase in profit growth.

ESG has gathered speed to become a seemingly unstoppable force across all industries. However, these corporate priorities are on a collision course with the probable and impending economic downturn. Companies are already postponing or eliminating new initiatives, reducing existing programs, and shedding workers (particularly in the tech sector).

There is no reason to think that ESG initiatives are not on the chopping block and lead many to question what value ESG brings to an enterprise. Our recent research has found that the bridge connecting ESG value to traditional business benefits is often missing — ESG responsibility in the C-suite.

Infosys’s global ESG Radar survey of more than 2,500 business leaders found several initiatives or focus areas that correlate with increased revenue or profit growth. The most financially beneficial of these initiatives go beyond ESG trainings, commitments to global standardsthat appease regulators and investors, or even technology advances. Instead, these areorganizational changesthattransform an enterprise’scultureandmethods — beginning at the highest ranks.

See also: Actioning Sustainability: How Tech is Making ESG a Reality

Company ESG efforts often skip the C-suite

Virtually all companies are committed to at least some elements of ESG, whether it is reducing their carbon footprint or ensuring employee welfare. Where they direct that attention — and investment — varies greatly, though.

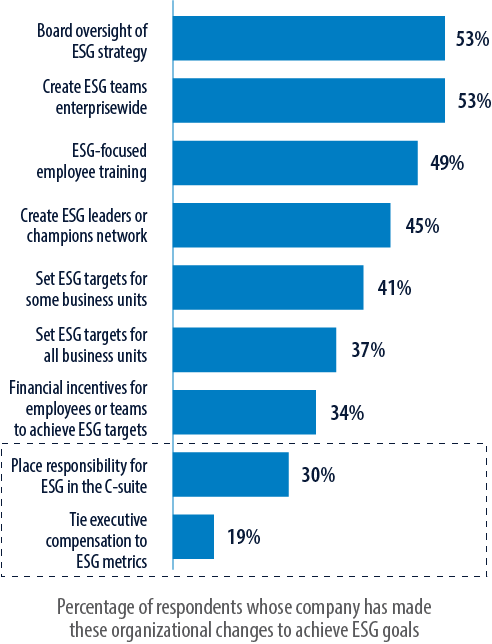

Our research found that companies’ ESG initiatives target their overall workforce rather than top leadership. Generally, the most common organizational changes made to achieve ESG goals included creating ESG teams and networks enterprise wide, employee training, and setting ESG targets for business units. At least 40% of respondents say they have made those changes as part of their ESG plans.

In contrast, the least common changes were ones focused on the executive ranks. Thirty percent say they place responsibility for ESG in the C-suite. And only 19% tie executive compensation to ESG — the smallest percentage of any organizational initiative.

These minimal commitments suggest that boards are concerned about whether incentivizing ESG could hurt financial performance or other business goals — even though 90% in our survey say that their ESG initiatives were moneymakers. These companies are likely to be pressured to make changes. A 2021 Institutional Shareholders Service survey found that 86% of investors believe that nonfinancial ESG metrics should be used in executive compensation programs.

This idea already has buy-in from many industry leaders. Apple now incorporates ESG metrics into executive cash incentives — an increase or decrease of as much as 10%. Siemens ties 20% of executive stock awards based on ESG KPIs. And aluminum giant Alcoa ties 20% of executive cash compensation to selected ESG goals.

ESG in the C-suite benefits the bottom line

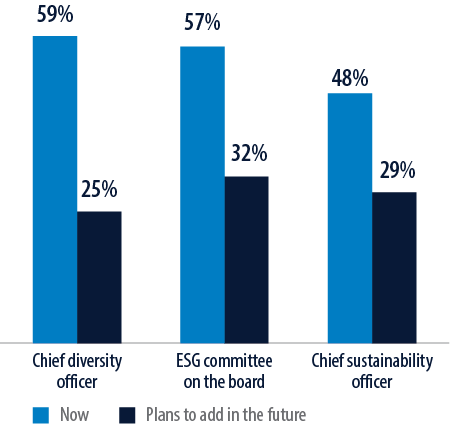

This hesitancy to bring ESG into the C-suite comes at a cost. Our research found that companies perform better financially when they have all the following: a chief diversity officer (CDO), chief sustainability officer (CSO), ESG committee on the board, and also when the CSO clears capital expenditures. Analysis of survey data found that those four elements correlate with about a 2-percentage point increase in profit growth and revenue growth.

Removing any one of those four factors severed the correlation, our research found. That’s a clear signal to companies that ESG needs a prominent place in the C-suite and on the board. And there needs to be some authority — in this case, financial — backing up those titles.

This was a particularly strong correlation in our study and the largest financial impact. However, just 27% of business leaders surveyed say their company has all four elements. One bright spot in this area is on the board: More than half of companies (53%) say they have created board oversight of ESG strategy.

Our research found that board commitment needs to extend beyond just committees. Companies with more women on the board performed better financially, according to our analysis. A 10-percentage point increase in women on the board strongly correlates with a 1 percentage point increase in profit growth.

There could be a variety of reasons this is happening. It’s a signal to current and prospective employees that a company is forward-thinking and seeks talent beyond a narrow, traditional network of contacts. Looking outside this comfort zone for board members may bring diversity of thought that can lead to greater innovation and help companies avoid costly mistakes. These results could also be attributed to better talent attraction and retention, which result in improved financial outcomes.

This finding is of particular interest to the tech industry, which has struggled to attract and retain women in the workforce. Despite the significant work of nonprofit groups and internal company efforts, a little more than one-quarter of US computing jobs are held by women.

Also, this effect is likely a proxy for board diversity. Analysis of companies on the S&P 500 found that boards with greater diversity correlated with better financial performance during the COVID-19 pandemic.

See also: Connecting the Digital and Physical Worlds to Address Sustainability

ESG in C-suite hitting a ceiling

While the leadership-focused approach to ESG is a financial winner, many companies do not see the value. Overall, firms that do not have the leadership positions or structures that were mentioned previously are not likely to add them in the future. About half or more of the companies we surveyed have ESG roles in top leadership: CDO (59%), ESG committee on the board (57%), and CSO (48%).

These numbers are not likely to increase significantly. Most of those who do not have these leadership elements in place say they do not intend to add them in the future. Roughly two-thirds reported their company has no plans to create a board ESG committee. Three-quarters do not plan to add a CDO to their C-suite. And a large majority (71%) do not plan to hire a CSO, a field that has grown by 228% in the US over the last decade.

There are ESG bright spots though. One of the most impactful changes is likely to come from the companies that already have a CSO. Few of those executives (32%) clear their company’s capital expenditures. About one-third plan to give their CSO that responsibility in the future, which would elevate the percentage to more than half of respondents surveyed and bring ESG authority into the C-suite.

Also, global efforts continue to make company boards more representative of the population. Moody’s Investors Service research found that women held 29% of company board seats at North American and European companies — up from 24% two years earlier. Additional research from the nonprofit 50/50 Women on Boards found that 37% of directors joining the boards of Russell 3000 companies in the third quarter of 2022 were women.

ESG requires leadership

Corporate leaders now face increased pressure from the board, customers, and employees to prioritize ESG initiatives. But the pressure is not great enough (at least not yet) to fully place ESG responsibility into the C-suite.

Companies have generally treated ESG as a compliance issue and not as a business opportunity. This shallow approach assures that businesses spend just enough to accomplish the bare minimum but not enough to truly advance their ESG goals. Companies that approach ESG as the way they do business are the ones more likely to invest and to succeed.

This is where the C-suite can make the greatest impact. Leaders at this level are the ones who can see how every part of the enterprise fits together: operational and organizational, tactical and strategic. ESG-focused C-suite executives are the ones best suited to determine how to meet ESG goals without sacrificing conventional business goals like profit and share price. They can convert ESG from a noble purpose or regulatory mandate to the company’s North Star.

The expected economic downturn will certainly stress corporate budgets. However, those most likely to succeed when the next recovery arrives are the companies that are the most prepared for the new market that emerges. In the long term, ESG will only become more important. Even when times are tough, companies need to position themselves for the landscape that will exist in a year, or 5 years, or 10 years. Part of being prepared means having the right people leading the ESG journey.