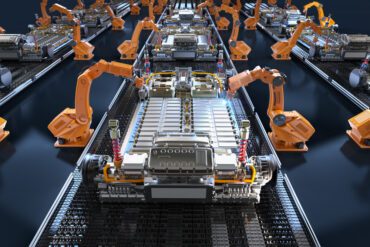

Device, data, and systems integration is crucial for just about every use case in the industrial IoT.

Businesses looking to profit in the industrial IoT space know the different major factors at play: how to deal with big, fast data; how to make the physical installation as easy and cheap as possible, and how to maintain a high degree of security. The problem of IoT integration—and it is a problem—doesn’t quite get the same focus.

According to a recent report from Gartner and Bit Stew Systems, half the cost of implementing IoT solutions will be spent on integration — that includes device and data integration, back-end system integration, and third-party middleware integration. The report states that by 2020, 75 percent of IoT projects will use a third-party integration platform, adding to the overall complexity of an IoT rollout.

Integration is crucial for many IoT projects because it is only by combining data, devices, and different systems – for example sensors, machines, and database systems – does a profitable use case emerge. Yet integration is often hampered by a dizzying array of machine protocols as well as legacy or siloed systems.

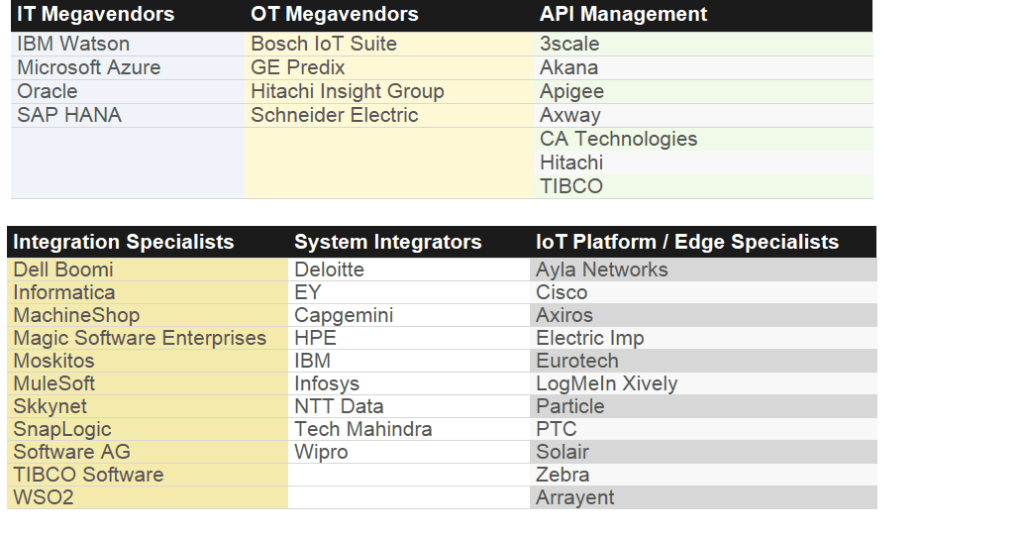

IoT companies and integration

To help better understand the landscape, Gartner and Bit Stew break down IoT companies into a number of categories and consider their integration capabilities:

IT megavendors

These IoT companies have their own integration platforms, and often have an entire portfolio of solutions, usually targeted at general-purpose application and data integration needs in industrial IoT, whether it’s cloud service integration or B2B needs. For integration, they might use enterprise service bus (ESB), an integration platform-as-a-service, API management, or a combination of these. Megavendors include IBM and their Watson IoT platform, Microsoft’s Azure, Oracle and its IoT Cloud Service, and SAP HANA (PaaS) offerings.

OT megavendors

These companies differ from IT megavendors in that they more precisely spend their R&D on very specific IoT capabilities, and are found closer to the edge, particularly when it comes to data ingestion and real-time analytics. These systems often support common OT protocols (such as SCADA) and rely on APIs for integration. The Bosch IoT Suite is one example, along with GE’s IoT offerings, built on its Predix program. Hitachi Insight Group partners with Atmel (a manufacturer of microcontrollers and semiconductors, plus related software); Intel ( gateways, microprocessors), and Nexcom (gateways) for its own solution.

IoT platform/edge specialists

These companies are more focused on IoT platform capabilities or IoT edge capabilities. APIs are commonplace among these solutions for interoperability and security, and many companies rely on other partners to help make integration truly seamless. There are a bevy of companies in this space, including Amazon, Cisco, PTC, Solair (recently acquired by Microsoft), Zebra, and more.

Integration specialists

These companies don’t offer their own IoT platform, but do offer an integration platform solution, either as an ESB, iPaaS, or other tools. Adapters are commonplace, to help bridge the space between various IoT platforms and implementations. By partnering with megavendors and specialists, these companies help fill integration gaps. Providers include Bit Stew Systems, Dell Boomi, MuleSoft, Software AG, and more.

API management specialists

These companies help define role-based API security, as well as policy management and enforcement, in the integration landscape. These tools can be used standalone or in conjunction with IoT platforms from the IT/OT megavendors. 3scale, Akana, Hitachi, and more operate in this thin-but-crucial space.

System integrators

Integrators will work with a number of IT/OT partners to attempt to deliver a comprehensive solution for specific integration scenarios, but are also often responsible for taking advantage of existing investments in integration infrastructure. Accenture, Deloitte, Hewlett Packard Enterprise, Infosys, and Wipro are all well-known players in the system integration field.

Prepping for integration

IoT project leaders and other IT leaders, whether in the C-suite or not, must prepare for the integration costs and complexities to come—budgeting to account the 50 percent that will go toward integration is only part of the solution. Companies should first perform due diligence in understanding all their integration requirements before reaching out to any vendors in order to find the best solution. Even then, leaders should be ready to reach out to third parties when needed, particularly when it comes to adapters and API management.

So — monolithic IoT system from an IT megavendor, or multiple edge solutions tightly integrated with a third party? IT leaders need to think hard about not only what they need to get done, but also how they’re going to make it all fit together—particularly as integration costs continue to rise.