“Blockchain theoretically enables the car to become a smart asset because it can auto-manage services like auto insurance, lease payments, tolls, parking — even your coffee at Starbucks.”

Car leasing is a big business these days. With millions of leased vehicles on the roads, tracking the status of them can tax even the most robust systems and processes. Leasing a car invokes many systems across a chain of processes – including verifying the driver’s financial status, driving eligibility, available vehicle inventory and available car features. Then, leasing companies and financiers need to know what is happening with vehicles after the lease is signed. Perhaps blockchain technology can keep things up to speed with smart contracts?

That’s the goal of a partnership between DocuSign and Visa, which have a blockchain pilot designed to introduce greater speed and automation to the car-leasing process.

The proof of concept employs blockchain “to bring together smart contracts and secure payments to create a connected, IoT-enabled car-leasing experience,” Ron Hirson, head of product at DocuSign, tells RTInsights.

Smart contracts are the most important component of blockchain, “where any agreement or contract that is highly sensitive and involves multiple parties can benefit from the blockchain’s independence and distributed system of record,” he says.

“With smart contracts, we are able to create self-executing contractual states, stored on the blockchain as a public ledger, which can act based on information or events from other systems, while keeping the data durable and reliable. The shared ledger can record signatures and agreements that can be validated on the blockchain. Smart contracts like this could be used in financial services, the public sector, healthcare, or legal proceedings, for example. Anywhere where a public ledger account of a contract or agreement adds value.”

A simplified leasing process

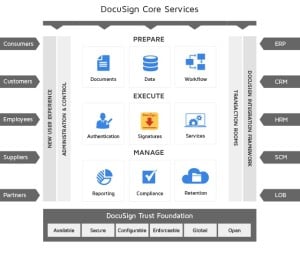

The goal of the blockchain-enabled car-leasing pilot is “to simplify the process of leasing or buying a car by automating all the steps in a seamless, completely secure electronic environment,” he says. The concept employs:

- DocuSign’s API.

- Docusign’s Digital Transaction Management platform and eSignature solution.

- Visa’s Token Service for secure payment processing.

- Blockchain as a public ledger.

“This is a great example of the value blockchain could provide in a transaction,” Hirson points out. The intention with this concept is “to bring a 100% digital, fully connected experience to life within the Internet of Things, supported by DocuSign Smart Contracts as the control point of the car – and to do it in a way that’s quick, simple and completely secure for everyone.”

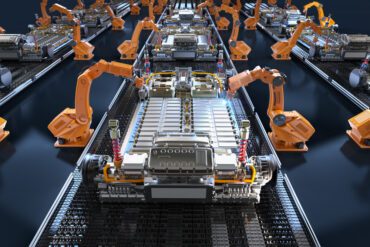

Blockchain as the foundation for smart assets

The car-leasing proof of concept also demonstrates the increasing role of IoT-enabled initiatives, Hirson points out.

“The blockchain technology theoretically enables the car to become a smart asset among the Internet of Things because it can auto-manage services like auto insurance, lease payments, tolls, parking, even your coffee at Starbucks. When you consider the sheer magnitude of IoT, you could apply our DocuSign/Visa concept practically anywhere – like renting or buying your new home and setting up all the services and utilities you might use, from Internet to cable to telephone to electricity, gas, sewer and water.”

Hirson explains how the car-leasing engagement would flow across blockchain-enabled processes. “A prospective customer would choose the car they want to lease after a test drive, evaluate their options, and complete any pre-approvals. That car’s identity would then be registered on the blockchain. From the driver’s seat, the customer then chooses the lease options for the car – such as number of miles to be driven each month — and then DocuSigns the leasing contract right from inside the car using a DocuSign Smart Contract. This is all in turn updated on the blockchain as a public ledger.”

The capability extends to insurance as well. The customer then chooses their insurance options in the same way — think selecting the company and coverage,” Hirson adds. “They would again DocuSign the contracts, and the blockchain would again be updated as the public record of the transaction. The customer then links their Visa credit card details to pay for the lease and insurance, and to automatically cover in-car payments like tolls, parking, maintenance services, music downloads or multimedia content, take-out food, and even charges from somewhere like the DMV. “

“With the lease and insurance contracts DocuSigned and the Visa credit card details integrated, the customer is literally ready to drive off the lot in their connected car supported by smart contracts in a mere matter of minutes,” he predicts.

The process continues during the life of the lease, Hirson continues. “Once a customer has been driving the car for a period of time, the system can start to track activities – distance traveled, average speeds, hard-breaking events, for example – and potentially deliver savings on insurance, or advice about cheaper leasing options and driving routes.”